Financial Planning

Introduction

The internet is full of financial gurus and self-proclaimed experts who claim to have the secrets and strategies to help you achieve financial freedom and live the life you want.

- However, is it really that easy to attain financial stability, especially at young age?

I believe that the mathematical equation of our financial status can be represented as follows:

Financial Savings = Income - Expenses

Increasing our income and reducing our expenses are obvious ways to improve our financial situation.

Savings

Since childhood, we are taught that saving money is essential for financial success.

- We believe that if we want to be wealthy, we have to save consistently and diligently. Then, our savings will grow over time.

- This sounds simple and logical, but is not easy to practice.

As we mature, we realize that our childhood savings are insufficient to meet all of our goals and desires such as buying a car or a house and going for a vacation.

- Often, we decide to work harder to earn more money to improve our standard of living.

Nonetheless, the key in financial planning remains: It is not how much money you make. It is how much money you keep.

Incomes

Although we may think that putting in a great deal of effort always leads to a favourable outcome, this is not necessarily the case.

- Consider the example of traveling to Hong Kong, no matter how fast you cycle, it would not get you there any faster than taking a flight.

- Similarly, working harder does not always translate to higher income, as it is often constrained by the earning potential of your chosen career.

- Thus, it is important to recognize that while hard work is valuable, it is not always the sole determinant of success.

- On the other hand, investing in your education or acquiring in-demand skills can significantly influence your earning potential throughout your career.

In addition, some people choose to work part-time to have additional source of income to sustain family,

- However, it is important to remember that some part-time income can be unpredictable and fluctuate based on the number of hours worked. For instance, you may work very little during festive seasons, so this extra income should not be relied on for luxurious lifestyle, such as purchasing an expensive car or bungalow.

Nonetheless, it is important to maintain a balance between living a life and living to work.

- After all, money is earned in exchange for our time, effort and energy, and it should be used to enhance quality of life, but not to replace it.

- No one is irreplaceable at work, but your family and loved ones are. Spending quality time with them and nurturing our relationships are the things that matter most in life.

To become financially secure, apart from having a day job, we need to develop passive income streams by investing in assets that generate incomes. These can include

- Business that do not require our daily presence (Ones we own but are managed by others)

- Stocks and bonds

- Income-generating real estate, such as rents

- Royalties from intellectual property such as music, scripts and patents.

Wealth should be defined by how many days forward you can survive, if you stopped working and still covered your expenses.

Expenses

While our grandparents may have prioritized saving for a rainy day, many young people today believe in living in the moment.

- However, we should not forget that every luxury or lifestyle choice has a price tag attached to it.

- He replied, many young people are living with a minimal saving. They no longer seek to be rich, but satisfied with buying a car, buying a house, raising children and living a lifetime.

Daily expenses such as bills, groceries, transportation and social entertainment, as well as unexpected costs such as medical emergencies and car repairs, can add up quickly. Hence, it is worthwhile to keep track of our expenditures and eventually helps us to limit or reduce our monthly expenses.

- Believe me, you may be surprised on how much money you spend in a month.

- By tracking your expenses, you can identify areas to optimize spending without sacrificing your well-being. This allows you to allocate more towards your savings goals.

- There are many budgeting apps available which help categorize your spending. My personal favourite is Wallet: Budget Expense Tracker. It has a simple and neat interface and work seamlessly across devices. Another equally good alternative is Spendee.

Importantly, some expenses are necessary investments when the opportunity benefits you more, such as hiring staff for business operation or hiring a maid when your salary is higher.

Human Desires

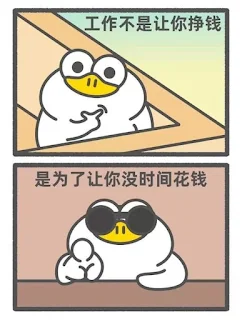

The biggest obstacle to saving money is our own desires.

- When we earn more, we often feel that we can afford a better quality of life and end up spending more. As a result, we will never earn too much money.

- To illustrate, when we are rich, our mentality changed. We stop putting the value of money as the first priority, but chasing for the best quality.

- However, a luxury car is generally a depreciating liability, not an asset. The moment you sign off on the purchase agreement, it loses a significant portion of its value. On top of that, luxury cars typically require more expensive maintenance, higher insurance premiums, and higher fuel costs.

To combat this, a practical way is to split our income into 2 bank accounts.

- The first account is solely for savings, which can be used for emergencies, investments or retirement.

- The second account is for monthly expenses such as rent, bills, food and miscellaneous.

- By planning ahead and sticking to our budget, we can avoid overspending on unnecessary purchases.

In terms of mindset, it is important to accept that we cannot have everything we desire all the time.

- Life will throw challenges our way and often disappoints us.

- By understanding this, we can learn to manage our desires (delayed gratification) and prioritize long-term goals.

- Remember, not everything we possess is we necessarily "deserve", but rather a gift to be cherished.

- Rich Dad Poor Dad, 2017 highlights the observation that the rich buy assets, the poor only have expenses and the middle class buy liabilities but they think are assets.

- Those prioritizing immediate gratification often buy luxury items like big houses, luxury cars, diamonds, jewellery, because they want to appear wealthy. However, the reality is that they just get deeper in debt on credit.

- In fact, these bank loans keep pushing us to work endlessly and also can also lead to missed opportunities to invest in potential income streams.

- In her day, my grandmother likely noticed people preferred buying assets with cash saved beforehand, instead of relying on loans. In long-term, interests on bank loan could significantly increase the total acquired cost. When you are paying off a large loan, it feels like you are working for multiple entities - your employer, the government for taxes and the bank for interest. Hence, debt repayment strategies should always be considered.

Summary

Financial stability is a journey, not a destination.

- While saving money for investment is a key element in personal financial planning, it is important to strike a balance between saving and spending.

- Through expense tracking, prioritizing needs over wants, and focusing on investing in assets (instead of accumulating debt), we can build long-term financial stability and secure a comfortable future.

Comments

Post a Comment